Selling A Business

How To Sell Your Accounting Service Business

I have been selling businesses for a long time and recently sold a non-CPA run Accounting Service. I thought the market poorly documented business values and wanted to write an article about it. This article will hopefully help those owners of Accounting Services, CPA or non-CPA run, who wish to sell their businesses. I think these practices are becoming more and more attractive as cash flowing entities to many financial types and not just owner operators. This is certainly a positive for sellers as the pool of buyer demand is increased. Read on for a summary of important considerations for Accounting Service sellers.

Tips To Properly Sell Your Accounting Service Business

There are certain basic practices that apply to selling most businesses that also apply to Accounting Services. I do not have to tell you to make sure you are current on all your tax filings! Here are a few other items you should address: If a family member works at the business and will not be staying, then they need to be transitioned out of business. If there are assets on your books that are not currently used in the business, you should remove them. You also want your business to show well. Make inexpensive cosmetic changes to your office, like replacing ceiling tiles and applying a coat of paint. Empty that cluttered storage closet. Organize your corporate documents, leases, client engagement letters, etc., so they are readily available.

The value of the business is one of the biggest questions most owners have when they are preparing to sell. When using a comparative sales method, those seeking to value a business look for statistically meaningful data. That is usually defined by a large enough data set telling a consistent story. That is not the case for CPA or non-CPA accounting practices with $300k-$700k in sales. It is a statistical mess, in my opinion. It is not much better for larger practices. There is a decent percentage of buyers that are sure all practices are worth 1.25 times the gross sales. This is a total myth.

Here are some of the things that truly matter in understanding the value of an accounting business:

- Profitability: Owner benefit measured by SDE or EBITDA (most important element).

- Seasonality: Year-round business is favorable versus high tax concentration.

- Seller/Client Relationships: If the seller has a strong direct relationship with each client, attrition will be higher when the seller exits, and therefore practice value will be lower.

- Market Desirability: A Raleigh, NC, practice will sell for more than the same practice in Wadesboro, NC, simply because of supply and demand.

There is no silver bullet for determining the selling price of practice, but considering the real drivers of value is of great importance.

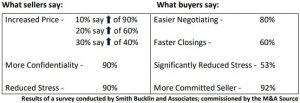

Most business owners benefit from representation by a business broker. My experience has been that increased selling price far outweighs commission expense, and there are a host of other benefits. When choosing representation, try to speak with more than one broker and ask for references. An M&A Source commissioned study shows that you can get the most out of your sale by using a business broker professional, as illustrated by the chart below.

Timing is another issue in selling an Accounting Service. Many buyers expect the seller to work through a tax season with them, full or part-time. A reasonable approach may be starting to sell in June, and it might take you a year to fully extricate yourself from the business. This will increase your chances of getting the best price. The amount of time the seller works in the business after the sale varies; the benefit to the buyer is to ease the transition and retain clients. One last piece of advice to sellers is not to tell employees or clients of your selling plans. This is damaging to your business’s value. Even though sellers occasionally feel guilty and compelled to tell their employees, in almost all cases, they are doing their employees a disservice by telling them. People don’t like uncertainty, and this knowledge is an unnecessary burden to place on them.

It is not that hard to sell if you plan. If you still want to work, it is easy to have part- or full-time work that is allowed in your non-compete, or you could work for the buyer. In my experience, there appeared to be a lack of understanding of how to value accounting services. I hope this information is helpful to sellers and buyers alike.

Sunbelt Business Brokers of Raleigh

Mark Richie owns the Raleigh office of Sunbelt Business Brokers. He is a member of the International Business Brokers Association, where he holds the designation of Certified Business Intermediary (CBI). He is also a member of the M&A Source, where he holds the designation of Merger & Acquisition Master Intermediary (M&AMI). [email protected]