Selling A Business

COVID-19 Update (March 24, 2020): 10 M&A Recommendations to Business Owners Working on a Succession Plan

10 M&A Recommendations to Business Owners Working on a Succession Plan

We at Sunbelt Business Advisors of Southwest Ohio are closely monitoring the impact of the coronavirus on businesses and on business owner’s plans for their succession planning. Please consider us a valued resource and contact us with any questions you may have about the market or best ways to maintain your business value and marketability.

We’re all in this situation together.

The full impact of COVID-19 has yet to reveal itself. As a result, many business owners are putting off one of their most critical decisions – working on and implementing their exit strategy or retirement plan.

While there is a lot of uncertainty, it is important to remember that the foundation of our economy is strong. There have been many comparisons made to the 2008 financial crisis, but we need to remember that we are not in a banking/financial crisis. Balance sheets are strong, interest rates are low, and capital is available for business growth and acquisition. In addition, Federal and State governments are putting plans in place to intervene with stimulus packages to bolster the economy.

If you are in the process of working on a succession plan or exit strategy, we suggest you continue with those plans. Here is our reasoning:

- We continue to see a very active buyer market. There is plenty of money held by strategic buyers, private equity groups and high net worth individuals who are looking to leverage those assets through the acquisition of successful business operations.

- One advantage of a sale is the cash it provides in order to ride out the economic impact of the coronavirus, without needing to touch your investment accounts.

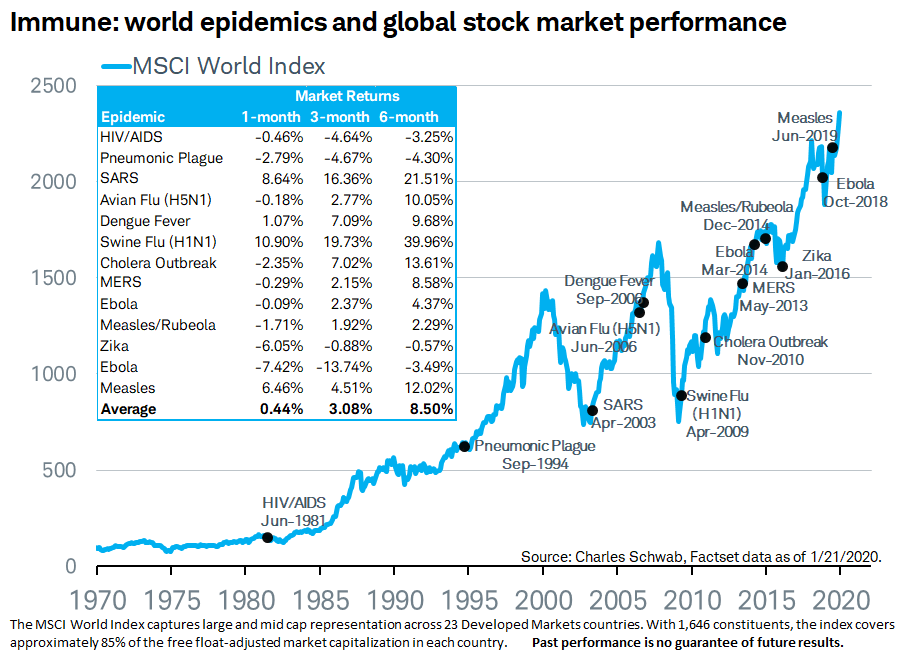

- Additionally, the sale will provide cash to take advantage of low prices in the equities market that may provide huge gains when the economy turns. And the economy will turn. Below is a chart showing stock market performance after a major epidemic. While the past can’t predict the future, there are many reasons to believe the U.S. economy will pivot off of recent losses in the market.

This chart comes from an article in MarketWatch, published on February 24, 2020 and written by Mark DeCambre. Read the entire article at epidemics and stock performance.

In order to be in a position to take advantage of this buyer market a company must be able to show it is still strong and worthy of an investment by a buyer. Right now is the time to maintain and grow the value of your business.

1) First and foremost, lead. While there may still be some skepticism that the impact of the coronavirus will be as devastating as feared, you must lead your business for a worst case scenario. “Plan for the worst and hope for the best” is a strategy that works and needs to be followed during a time of uncertainty. Social distancing and constantly cleaning surfaces are practices that need to be implemented now.

2) Keep operating at the highest level possible. Each business and industry are impacted differently, but if you are able to continue providing service to your customers put the best possible procedures in place. Follow guidelines laid out by the local and national government and industry groups. Ashley Webb, owner of Paradigm Industrial and Vulcan Tool, posted this article to LinkedIn last week, a message to business owners regarding suggestions to limit exposure in the workplace.

3) Keep your key employees and skilled labor. I realize this sounds easy, but is a huge challenge. Talk to your banks about a line of credit or other types of loans available in order have enough working capital to withstand this assault on your business. Do whatever it takes to keep your skilled labor, because if you don’t someone will pick them up and the long-term ramifications will be worse than the effects on your balance sheet from a loan. If your work is slowing or you’re shut down consider the following:

- Work on your strategic plan with your board of advisors and your supervisors. You can do this remotely and it will serve two purposes – maintain and improve your ability to survive and thrive and to keep your key employees engaged in a meaningful way.

- Document any processes that haven’t been memorialized and update those that have. A key to business transition is for a buyer to see how quickly they can get up to speed on business operations.

- Perform any preventative maintenance on equipment needed to make sure you are ready when your customers are.

- Use the time to implement on-line training for your managers and supervisors. Look to your suppliers and equipment manufacturers for any on-line training they offer that could improve your productivity. Now’s the time to take advantage of any state training grants or other programs available to offset training expenses.

- If social distancing is a challenge due to the number of employees you have and their work proximity to other employees consider adding a second shift that will spread the employees out to safer boundaries.

- If your employees are off make sure to keep in touch with them. Reconfirm their importance to you and keep them apprised of any new, useful information to help them through this. Also, find ways to be a resource to their families.

4) Keep your customers. The best way to do this is to stay in touch with them. If you are still operating, let them know the plans you’ve put in place to make sure your business can continue to operate effectively. Show your customers your plan of action and that you will be there as a strong link in their supply chain. If you’ve needed to close or significantly slow down, you need to make your customers aware and share your plans for coming back stronger than ever.

5) Improve yourself. If you have downtime, use it to work on your strategic plan. Work on your management skills with consultants and other organizations available to you. Aileron and the Goering Center come to mind.

6) Improve or begin a strong relationship with your bank or other lending sources. Don’t wait until that last minute if you need working capital. Start the discussions now. Find out what options are available from lenders. Make sure they keep you updated on their loan options and any that may come from government entities.

7) Now is the time to act to improve your position in the market. The bullet points below are from an article written by an economist with ITR Economics which outlines some opportunities related to the coronavirus crisis. ITR Economics has a 94.5% forecast accuracy. The article has been edited by Sunbelt. To see the full article go to ITR – Time to Act?.

- There are three ways to respond to a crisis: succumb to it, survive it, or leverage it to your advantage.

- Descending interest rates are an early outcome – and opportunity – presented by COVID-19, making this an excellent time to leverage up and make purchases that will help you grow your business when the economic cycle transitions back to rise.

- Costs are often lower at the bottom of the business cycle – not just for capital, but also for physical assets and capital equipment. Leveraging the uncertainty in this cycle may allow you to secure concessions from vendors or contractors that may have been inconceivable just 12 months ago, as well as finance your purchases at extraordinarily low rates.

- Think about your bottlenecks – they could be plaguing you right now – or anything that held your business back during the last peak of the business cycle in late 2018. For some, mitigating these obstacles could mean supplementing an aging fleet of trucks or vans; for others it may be replacing aging, breakdown-prone capital assets or even expanding physical office space to handle the rising head counts that will support expanding business.

- As in everything, there will be wins and losses. There will be some definite losses in the COVID-19 crisis – most significantly, the loss of life – but the crisis will present very real opportunities in 2020 as well. Fortune favors the bold.

8) Improve your sales processes. Now is the time to work on all of your business processes, but maybe the most important is to put a business development plan in place to ensure current revenue flow and improve your position for the future. Ways to do this include:

- Improve your online presence. If you don’t have a strong website, now is the time to make the investment. Prospective customers are still out there looking for solutions to their business or service needs. You must be available to them to find you and illustrate how you and your business are right for them.

- Work with experts. There is an overview for creating a sales process at HubSpot. Use these ideas as a template and find a person or organization that has shown expertise in your specific industry.

9) Enhance curb appeal. The first impression of a buyer may be the appearance of your business as they drive up to it. Now may be the time to address any issues inside and outside the business that will remove a negative first impression as an obstacle. Paint, landscape, clean, repair. These are also ways to keep employees engaged during a slowdown or shutdown.

10) Get a business valuation and appraisal of equipment and real estate. Knowing what your business is worth today will help you plan and make better succession planning in the future.

Let Sunbelt Business Advisors be a resource to you. We can help you every step of the way. We are closely monitoring the coronavirus epidemic and ways for businesses to successfully navigate these uncharged waters.

Contact us now for a no-cost, no-obligation consultation on how to plan, prepare and execute a successful exit, on your terms.